Licenses in progress: Payment institution (CEMAC zone) and PSP Agent (Europe)

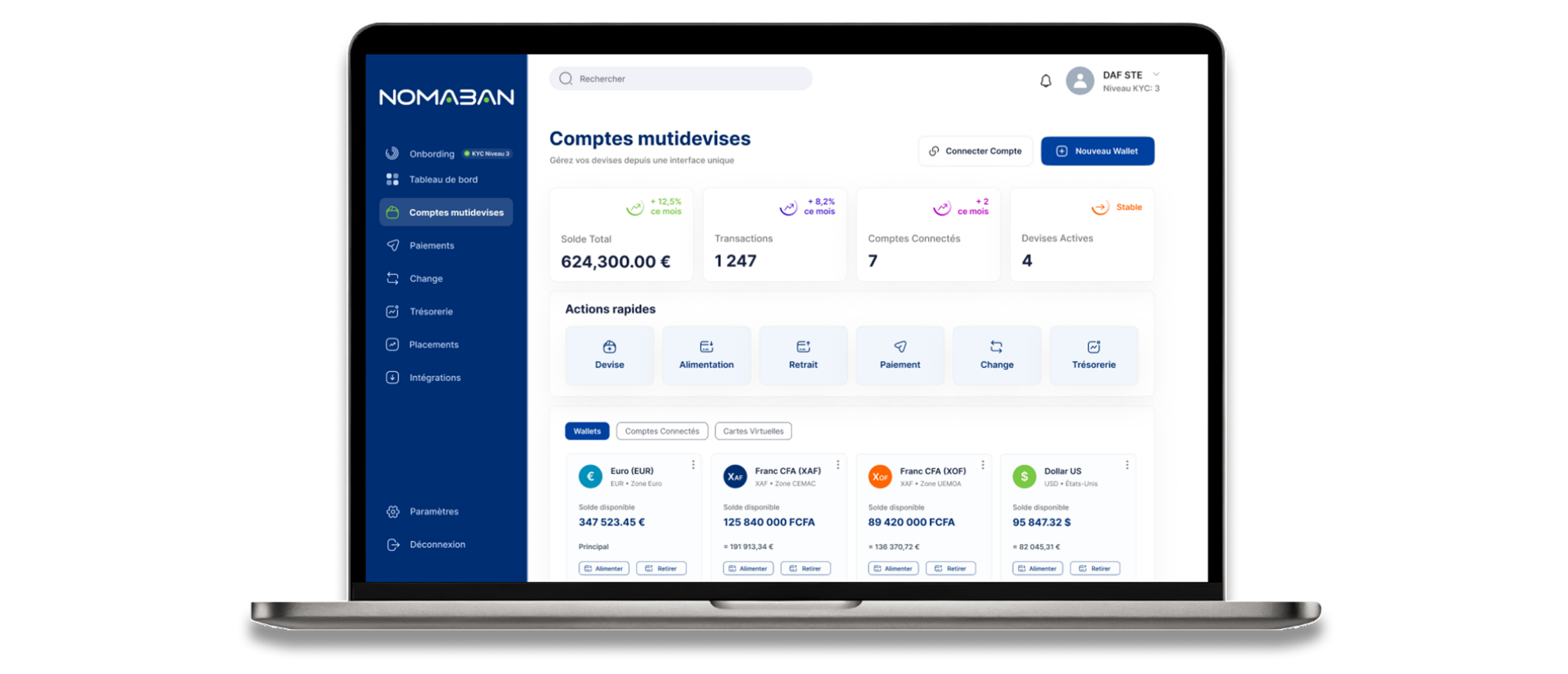

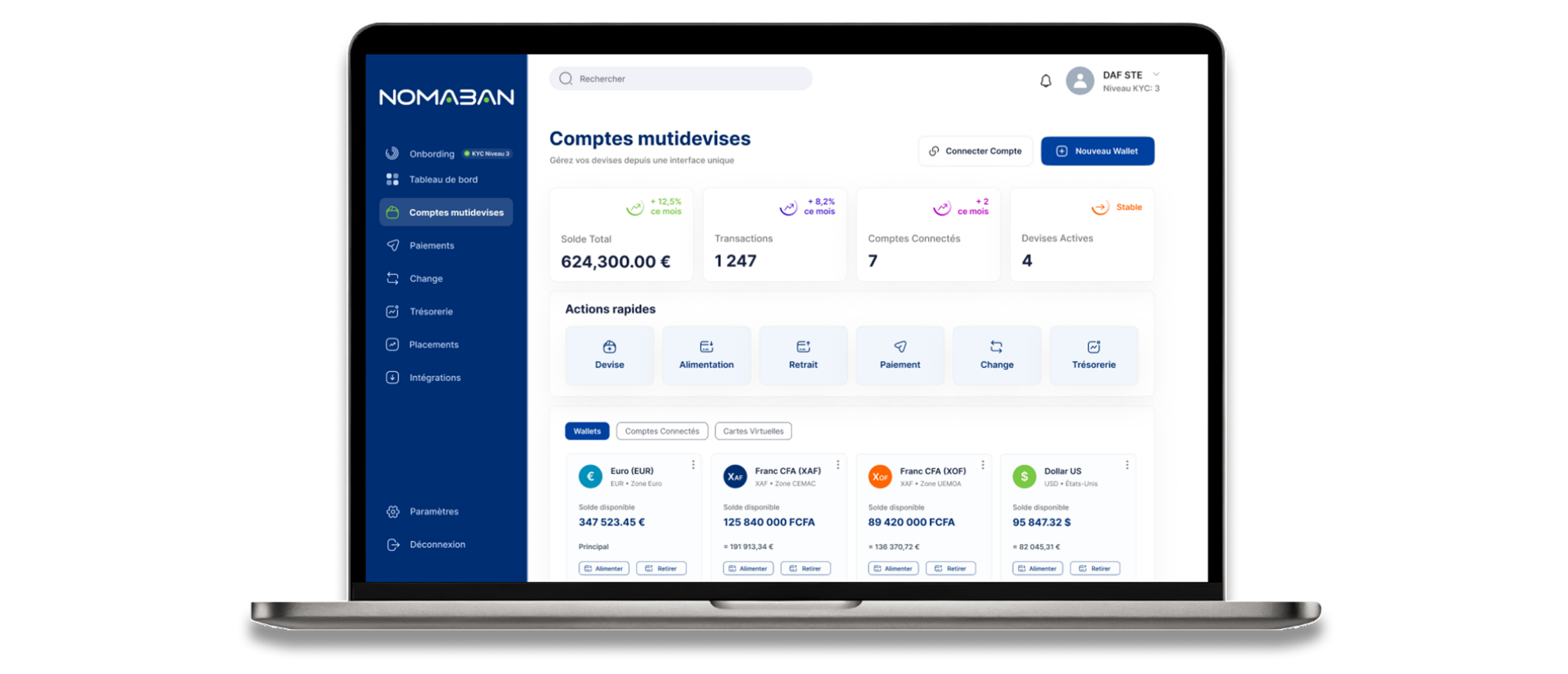

The multi-currency payments platform that connects Africa to the rest of the world

Pay your international suppliers, collect payments from clients worldwide, and manage your treasury in local and international currencies.

Licenses in progress: Payment institution (CEMAC zone) and PSP Agent (Europe)

The multi-currency payments platform that connects Africa to the rest of the world

Pay your international suppliers, collect payments from clients worldwide, and manage your treasury in local and international currencies.

Licenses in progress: Payment institution (CEMAC zone) and PSP Agent (Europe)

The multi-currency payments platform that connects Africa to the rest of the world

Pay your international suppliers, collect payments from clients worldwide, and manage your treasury in local and international currencies.

14

Countries covered in Central and West Africa

72h

Target time for an international payment

24/7

Platform availability

Countries covered in Central and West Africa

Target time for an international payment

Platform availability

Your international flows blocked?

We unlock them

Accessing currencies, sending cross-border payments, or collecting from abroad is still a challenge for businesses operating in Africa..

Receive international payments

- Receive international transfers in local and international currencies.

- Dedicated IBANs, transfers via local and international payment rails, with simplified conversion.

Pay your partners worldwide

- Make your international payments in compliance with local and international regulations.

- Optimized timelines and real-time tracking of your international payments.

Convert your currencies quickly

- Exchange between local and international currencies with transparent rates.

- No more waiting weeks to obtain currencies.

Vos flux internationaux bloqués ?

Nous les libérons

Accéder aux devises, envoyer des paiements transfrontaliers ou encaisser depuis l’étranger est encore un défi

pour les entreprises opérant en Afrique.

Accessing currencies, sending cross-border payments, or collecting from abroad is still a challenge for businesses operating in Africa.

Receive international payments

- Receive international transfers in local and international currencies.

- Dedicated IBANs, transfers via local and international payment rails, with simplified conversion.

Pay your partners worldwide

- Make your international payments in compliance with local and international regulations.

- Optimized timelines and real-time tracking of your international payments.

Convert your currencies quickly

- Exchange between local and international currencies with transparent rates.

- No more waiting weeks to obtain currencies.

Vos flux internationaux bloqués ?

Nous les libérons

Accessing currencies, sending cross-border payments, or collecting from abroad is still a challenge for businesses operating in Africa.

Receive international payments

- Receive international transfers in local and international currencies.

- Dedicated IBANs, transfers via local and international payment rails, with simplified conversion.

Pay your partners worldwide

- Make your international payments in compliance with local and international regulations.

- Optimized timelines and real-time tracking of your international payments..

Convert your currencies quickly

- Exchange between local and international currencies with transparent rates.

- No more waiting weeks to obtain currencies.

Join the Nomaban ecosystem

I am a Business

Do you operate in Africa or with Africa?

Simplify your international payments and optimize your multi-currency treasury.

Your benefits :

- Unified multi-currency account

- Fast access to currencies

- Local and international payments

- Automated compliance

- Dedicated multilingual support (24/7)

I am a Partner

Banks, microfinance, mobile money operators, fintechs or technology companies, marketplaces?

Enhance your services with the Nomaban solution.

Your opportunities :

- New revenue source

- API and White label available

- Turnkey international payment service for your clients

- Priority support

- Joint marketing actions

Why choose Nomaban?

A complete platform to manage your international financial operations

Enhanced Security

- Infrastructure compliant with international standards

- Data protected by advanced encryption technologies

Controlled Speed

- International transfers in 72h maximum

- Fast conversions between local and international currencies

Integrated Compliance

- Automated compliance with local and international regulations

- Regulatory documentation generated automatically

Dedicated Support

- Expert team available 24/7 in French and English

- Personalized support

Why choose Nomaban?

A complete platform to manage your international financial operations Enhanced Security

Enhanced Security

- Infrastructure compliant with international standards

- Data protected by advanced encryption technologies

Controlled Speed

- International transfers in 72h maximum

- Fast conversions between local and international currencies

Integrated Compliance

- Automated compliance with local and international regulations

- Regulatory documentation generated automatically

Dedicated Support

- Expert team available 24/7 in French and English

- Personalized support

Why choose Nomaban ?

A complete platform to manage your international financial operations

Enhanced Security

- Infrastructure compliant with international standards

- Data protected by advanced encryption technologies

Controlled Speed

- International transfers in 72h maximum

- Fast conversions between local and international currencies

Integrated Compliance

- Automated compliance with local and international regulations

- Regulatory documentation generated automatically

Dedicated Support

- Expert team available 24/7 in French and English

- Personalized support

An experienced team at your service

Nomaban brings together proven experts in international finance, technology, and payments. Our team combines deep knowledge of African realities with expertise in international reference standards.

Nomaban brings together proven experts in international finance, technology, and payments. Our team combines deep knowledge of African realities with expertise in international reference standards.

10+

Fintech and payments experts

2

Continents of expertise

24/7

Multilingual support

Ready to transform your international payments ?

Join the businesses and partners building the future of financial services in Africa.

Whether you’re a company looking to optimize your flows or a partner wanting to enhance your offering, we’re here to support you.

Join Nomaban

Join Nomaban

Fill out this form and an expert will contact you within 24 hours to assist you.

Fill out this form and an expert will contact you within 24 hours to assist you.

Fill out this form and an expert will contact you within 24 hours to assist you.

They transformed their operations with Nomaban

Marie K.

Jean-Pierre D.

Sophie L.

“Nomaban has simplified managing our treasury between Europe and our African subsidiaries. The platform is intuitive, flows are better controlled, and support is responsive. A reliable solution for our international operations.”

Ils ont transformé leurs opérateurs avec Nomaban

Marie K.

“Thanks to Nomaban, we now manage our payments between Europe and Cameroon in less than 72 hours. Timelines are reduced and better visibility on our financial flows has significantly improved the efficiency of our international operations.”

Jean-Pierre D.

“Nomaban facilitates receiving our European payments and settling with our international partners. Conversions are fast and pricing conditions are adapted to our volumes.”

Sophie L.

“Nomaban has simplified managing our treasury between Europe and our African subsidiaries. The platform is intuitive, flows are better controlled, and support is responsive. A reliable solution for our international operations.”

Ils ont transformé leurs opérateurs avec Nomaban

Marie K.

“Thanks to Nomaban, we now manage our payments between Europe and Cameroon in less than 72 hours. Timelines are reduced and better visibility on our financial flows has significantly improved the efficiency of our international operations.”

Jean-Pierre D.

“Nomaban facilitates receiving our European payments and settling with our international partners. Conversions are fast and pricing conditions are adapted to our volumes.”

Sophie L.

“Nomaban has simplified managing our treasury between Europe and our African subsidiaries. The platform is intuitive, flows are better controlled, and support is responsive. A reliable solution for our international operations.”

Frequently asked questions about our services

Frequently asked questions about our services

Frequently asked questions about our services

What are the transfer times between Europe and Africa?

International payments processed through Nomaban are generally executed within 24 to 72 hours, depending on the corridor, currency, banks involved, and local regulatory requirements. Thanks to our multi-currency payment infrastructure and flow optimization mechanisms, we significantly reduce delays compared to traditional banking channels, while respecting applicable compliance obligations.

Is Nomaban compliant with regulations?

Yes. Nomaban integrates compliance controls throughout the process (KYC/KYB, screening, traceability, and documentation). Our operations are designed to meet applicable requirements by country and corridor (particularly in Europe and the CEMAC zone), with documentation generated and stored to facilitate audits and inspections.

What types of organizations can use Nomaban?

Nomaban serves all organizations operating with Africa:

What currencies are available on the platform?

Nomaban supports major international currencies (EUR, USD, etc.) as well as local currencies such as XAF and XOF. Coverage will be progressively extended to other African currencies, in compliance with applicable foreign exchange regulations.